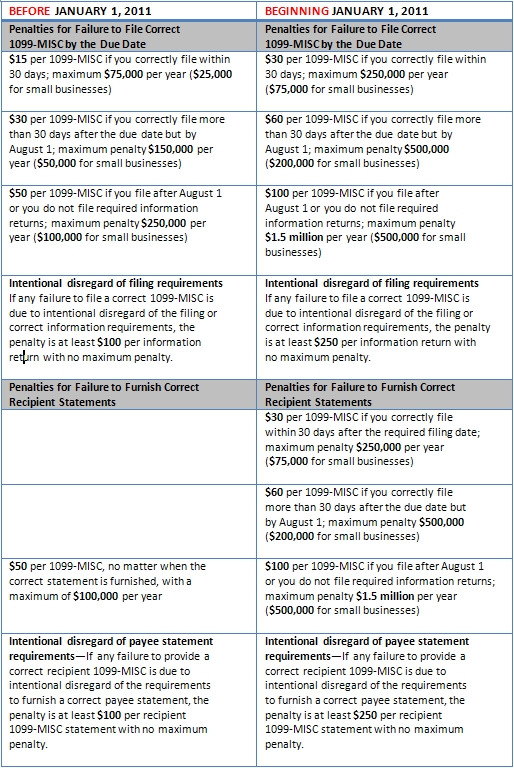

a small business for penalty

a small business for penalty

![]() what is a 1099 misc irs

what is a 1099 misc irs

1099 tax rule may bring big

1099 tax rule may bring big

do you know that the gain from the sale of a qualified small business is now

do you know that the gain from the sale of a qualified small business is now

all business payments or

all business payments or

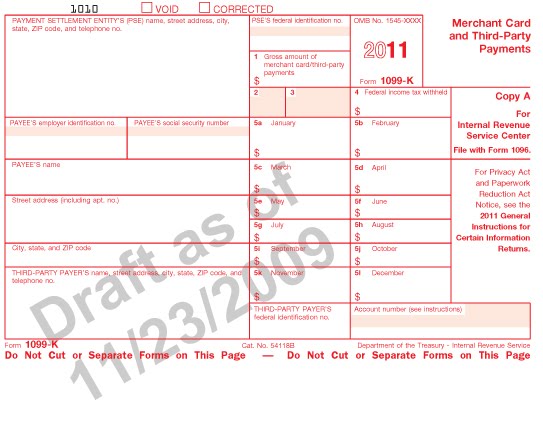

releases on the new 1099 k

1099 k

1099 k

scheduled to begin in 2012

scheduled to begin in 2012

businesses need to start

businesses need to start

1099k draft 2

beginning in 2011 businesses

beginning in 2011 businesses

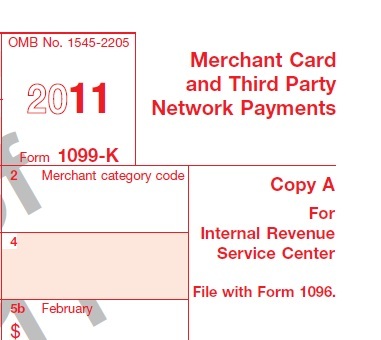

irs form 1099 k 2011

irs form 1099 k 2011

many businesses or merchants

many businesses or merchants

the small business tax relief

the small business tax relief

1099 k draft 090911

the new 1099 k aims

the new 1099 k aims

post image for form 1099 k

post image for form 1099 k

first year for form 1099 k

first year for form 1099 k

the 1099 k as a way to

the 1099 k as a way to

small business 1099 in 2012

small business 1099 in 2012

the 2011 and 2012 limits

the 2011 and 2012 limits